Securities

Silverman Thompson provides sophisticated legal advice in the heavily regulated securities industry. Members of the Firm’s securities group have represented a wide range of clients in a variety of securities transactions, regulatory matters, administrative arbitrations, and securities-related litigation.

We have extensive experience with private placements (including Rule 144A transactions), mergers and acquisitions, and venture capital investment transactions. We regularly counsel clients on all aspects of state and federal regulatory compliance matters including Blue Sky laws, reporting obligations, state registration requirements, exemptions, and broker-dealer regulations.

Our attorneys provide advice and counsel to officers, LLC managers, boards of directors, and investors on corporate governance and member/shareholder relations issues. With respect to securities litigation, members of Silverman Thompson have represented clients in some of the most noteworthy securities-related matters, including obtaining what was, at the time, the largest SEC whistleblower award ever issued. Our litigators regularly represent issuers, company management, brokers, and investors in all aspects of state and federal securities litigation.

Regulatory and Compliance Matters

In the course of structuring and reviewing complex business transactions, including public and private offerings, the securities group provides experienced counsel concerning compliance with applicable state, federal, and self-regulatory laws, regulations, and rules.

Our attorneys represent issuers, broker-dealers, brokers, promoters, and investors on all facets of compliance and regulatory matters. In addition, the securities group regularly represents clients during state and federal regulatory investigations and negotiates resolutions in formal actions before government and self-regulatory agencies.

Silverman Thompson represents clients in SEC enforcement actions, FINRA investigations, and state regulatory proceedings, including the Maryland Division of Securities. We also represent and counsel investors concerning the rules, laws, and regulations enacted to protect them in public and private investment offerings.

Securities Litigation and Arbitration

Silverman Thompson’s experienced litigators represent companies, officers, directors, shareholders, investors, and brokers, in a wide array of securities litigation, including:

- Shareholder actions arising from mergers and acquisitions

- Public and private offerings

- Derivative claims

- Securities fraud

- Whistleblower complaints

- SEC whistleblower awards

We regularly defend and assert shareholder and member derivative claims for breaches of fiduciary duty against corporations, limited liability companies, officers, directors, and managers.

The securities group has unique and extensive experience litigating reverse stock-split squeeze-out transactions, minority shareholder oppression claims, and securities fraud claims under the Securities Exchange Act of 1934 and claims for violations of the Securities Act of 1933.

Our attorneys have litigated federal and state securities fraud claims and civil RICO actions throughout the country, including Maryland, Delaware, Virginia, New York, Washington, D.C., Pennsylvania, California, Louisiana, Illinois, and Oklahoma.

Our clients include:

- Other financial institutions

- Public and private companies

- Partnerships

- Limited liability companies

- Officers

- Directors

- Shareholders

- Hedge funds

- Broker-dealers

The Corporate Transparency Act

Silverman Thompson’s experienced professionals counsel clients on compliance with a new, important law called the Corporate Transparency Act (CTA). Congress enacted the CTA in 2021 in the effort to combat illicit activity such as tax fraud, money laundering, and terrorism financing, by capturing ownership information for specific U.S. businesses operating in or accessing the country’s market. The CTA went into effect on January 1, 2024, and requires covered businesses to file and keep current a Beneficial Ownership Information Report with the Financial Crimes Enforcement Network at the U.S. Treasury Department no later than January 1, 2025.

The CTA has teeth: Owners of companies that fail to comply may be subject to harsh penalties including imprisonment for up to 2 years and a $10,000 fine, plus civil penalties for each day the company remains noncompliant.

Significant Cases and Results

- Obtained largest recovery of any creditor in one of the first plans of reorganization under Subchapter V of the Bankruptcy Code to be confirmed in Maryland

- Obtained seven figure recovery for client defrauded in complex asset-based financing fraud

- Represented hundreds of creditors in receivership and bankruptcy proceedings related to massive Ponzi scheme

- Obtained six-figure judgment against borrower and personal guarantors after trial in the Circuit Court for Prince George’s County, Maryland including judgment for recovery of client’s attorneys’ fees

- Litigated breach of contract case in the Superior Court for the District of Columbia resulting in favorable settlement

- Litigated breach of contract claims against borrower and guarantors in the U.S. District Court for the Middle District of Florida resulting in favorable settlement including payment of client’s attorneys’ fees

- Recovered collateral throughout Maryland and negotiated numerous forbearance agreements and payment plans with borrowers resulting in full payment of money judgments

- Frequently advise clients on business formation and entity choice and prepare corporate documents, including Articles of Incorporation, corporate bylaws, SAFE agreements

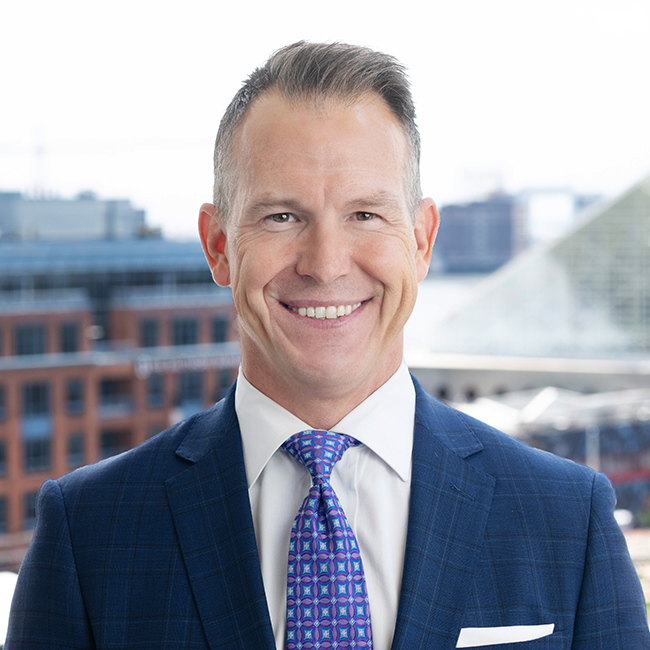

Meet Our Team