Asset-Based Lending and Commercial Finance, Equipment Lease Financing & Secured Transactions

Growth Through Leverage

A growing and successful business may find itself holding a tiger by the tail—facing stagnation or failure or losing a competitive edge because it lacks the capital needed to fund growth or meet other challenges organically. Whether a business needs cash to purchase raw material, hire a talented workforce, open new facilities, acquire equipment for operations, increase production to meet market demand, or for many other reasons, a commercial loan or equipment lease is often the answer.

Commercial financing takes many forms to provide key leverage for growth, diversification, business acquisitions, and daily operations. Commercial lenders provide access to capital that allows successful businesses to meet their goals.

On the lending side, Silverman Thompson’s experienced commercial finance professionals provide legal guidance and loan documentation services to commercial banks, institutional lenders, asset-based lenders, factors, and specialty finance firms around the country.

Our attorneys have decades of experience negotiating and drafting loans, security agreements, intercreditor and subordination agreements in mezzanine and subordinated debt transactions, corporate and personal guaranties, and other credit enhancement vehicles, conditional forbearance agreements, among other tools of commercial lending. In addition to the “front end” of commercial finance, our attorneys enforce obligations evidenced by all these agreements in state, federal and bankruptcy courts every day, with hundreds of successful recoveries.

Our attorneys are cutting-edge, regular contributors to the advancement of commercial finance law. Silverman Thompson Partner Steven Leitess is a past president of the American College of Commercial Finance Lawyers and presently serves as chair of the Maryland delegation to the Uniform Law Commission. The ULC was instrumental in the drafting and continued modernization of the Uniform Commercial Code, perhaps the key component of the substantive law of commercial finance.

Representative industries with which Silverman Thompson attorneys have documented or enforced commercial finance transactions include:

- Aviation

- Automobile and truck fleet financing

- Commercial real estate

- Construction

- Cosmetics

- Equipment leasing & finance

- Floorplan finance

- Healthcare

- High tech

- Hospitality and entertainment

- Invoice factoring and financing

- Manufacturing

- Marine

- Merchant cash advance lending

- Mining

- Railroad and rolling stock

- Retail clothing

- Retail electronics

- Small Business Administration

- Transportation

- Trucking and logistics

Significant representation includes:

- Obtained six-figure judgment against borrower and personal guarantors after trial in the Circuit Court for Prince George’s County, Maryland including judgment for recovery of client’s attorneys’ fees

- Litigated breach of contract case in the Superior Court for the District of Columbia resulting in favorable settlement

- Litigated breach of contract claims against borrower and guarantors in the U.S. District Court for the Middle District of Florida resulting in favorable settlement including payment of client’s attorneys’ fees

- Recovered collateral throughout Maryland and negotiated numerous forbearance agreements and payment plans with borrowers resulting in full payment of money judgments

- Advise clients on business formation and entity choice and prepare corporate documents, including Articles of Incorporation, corporate bylaws, and SAFE agreements

- Obtained largest recovery of any creditor in one of the first plans of reorganization under Subchapter V of the Bankruptcy Code to be confirmed in Maryland

- Obtained seven-figure recovery for client defrauded in complex asset-based financing fraud

- Represented hundreds of creditors in receivership and bankruptcy proceedings related to massive Ponzi scheme

Silverman Thompson provides sophisticated legal advice in the heavily regulated securities industry. Members of the Firm’s securities group have represented a wide range of clients in a variety of securities transactions, regulatory matters, administrative arbitrations, and securities-related litigation. Learn more about our team’s extensive experience in securities here.

For additional information, please contact Partner Steven N. Leitess at 410.385.6248 or at sleitess@silvermanthompson.com.

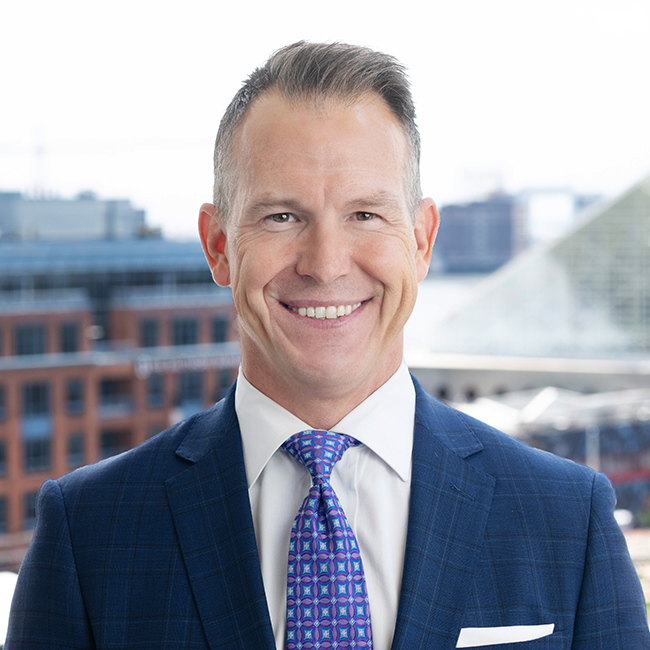

Meet Our Team